EQ3 <- sapply(1:(2*N), function(n){

# Market Mechanisms

demand <- qd_fun(P)

supply <- qs_fun(P)

# Compute EQ (what we observe)

eq_id <- which.min( abs(demand-supply) )

eq <- c(P=P[eq_id], Q=demand[eq_id])

# Return Equilibrium Observations

return(eq)

})

dat3 <- data.frame(t(EQ3), cost='1', T=1:ncol(EQ3))

dat3_pre <- dat3[dat3$T <= N ,]

dat3_post <- dat3[dat3$T > N ,]

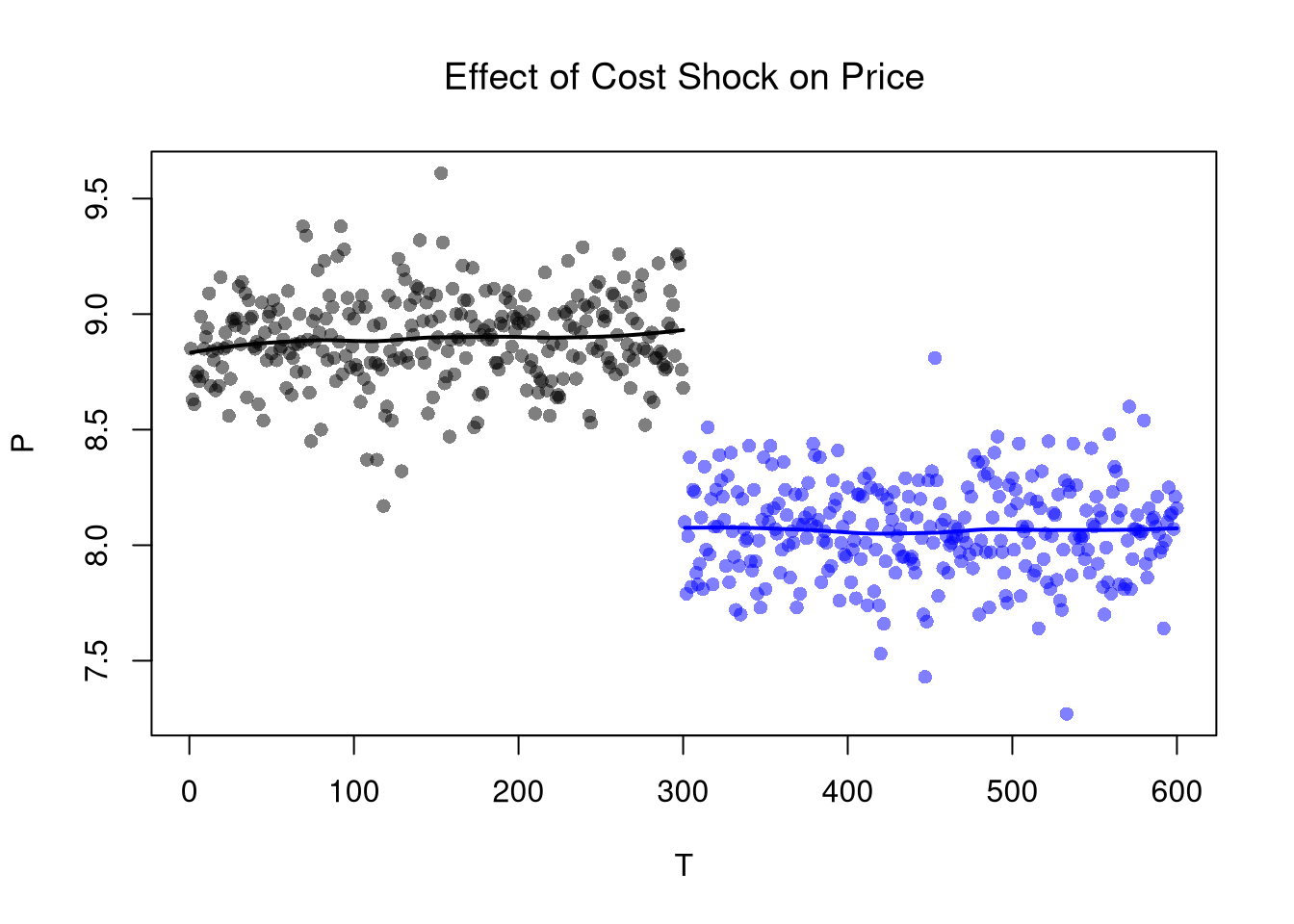

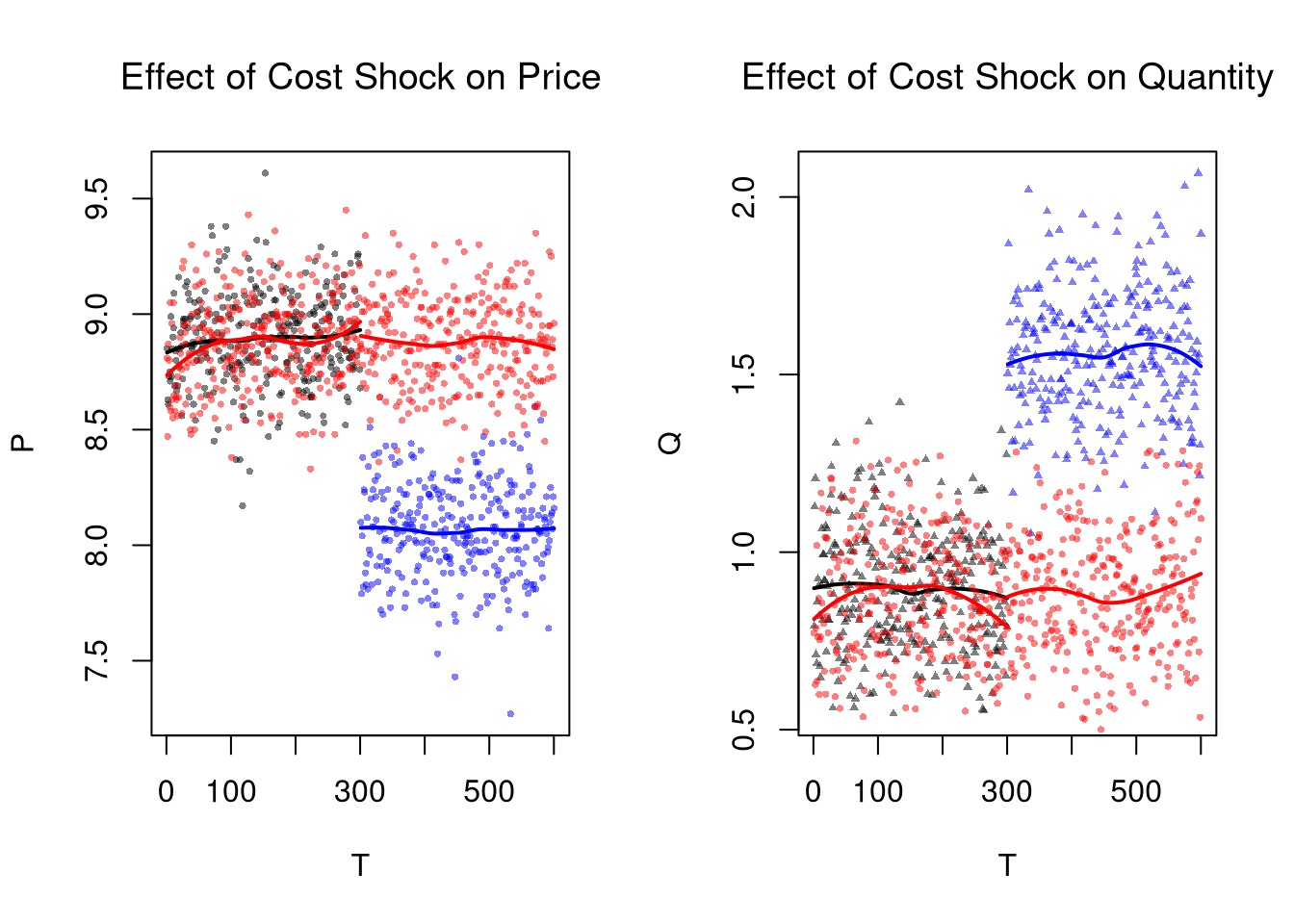

# Plot Price Data

par(mfrow=c(1,2))

plot(P~T, dat2, main='Effect of Cost Shock on Price',

font.main=1, pch=16, col=cols, cex=.5)

lines(x1, predict(regP1), col=rgb(0,0,0), lwd=2)

lines(x2, predict(regP2), col=rgb(0,0,1), lwd=2)

# W/ Control group

points(P~T, dat3, pch=16, col=rgb(1,0,0,.5), cex=.5)

regP3a <- loess(P~T, dat3_pre)

x3a <- regP3a$x

lines(x3a, predict(regP3a), col=rgb(1,0,0), lwd=2)

regP3b <- loess(P~T, dat3_post)

x3b <- regP3b$x

lines(x3b, predict(regP3b), col=rgb(1,0,0), lwd=2)

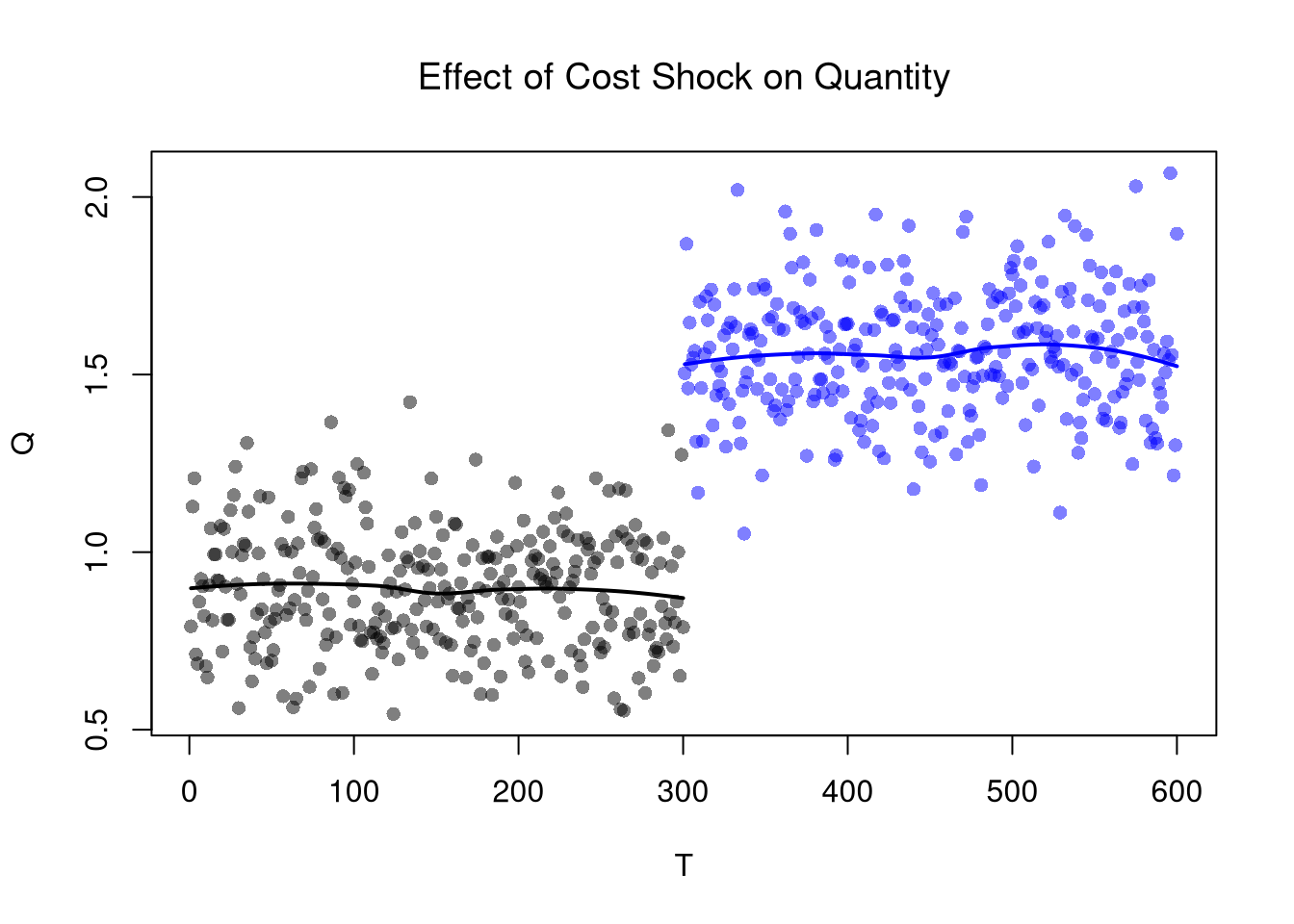

# Plot Quantity Data

plot(Q~T, dat2, main='Effect of Cost Shock on Quantity',

font.main=1, pch=17, col=cols, cex=.5)

lines(x1, predict(regQ1), col=rgb(0,0,0), lwd=2)

lines(x2, predict(regQ2), col=rgb(0,0,1), lwd=2)

# W/ Control group

points(Q~T, dat3, pch=16, col=rgb(1,0,0,.5), cex=.5)

regQ3a <- loess(Q~T, dat3_pre)

lines(x3a, predict(regQ3a), col=rgb(1,0,0), lwd=2)

regQ3b <- loess(Q~T, dat3_post)

lines(x3b, predict(regQ3b), col=rgb(1,0,0), lwd=2)